Understanding Wealth Inequality: A Multifaceted Perspective

Wealth inequality is a pressing issue that affects societies worldwide, influencing economic stability, social cohesion, and individual well-being. The disparities in wealth distribution raise critical questions about fairness, access, and opportunity. This blog post aims to explore the multifaceted nature of wealth inequality, delving into its historical roots, economic implications, and social dimensions. By understanding these factors, we can better address the challenges that wealth inequality presents in our contemporary world.

The Nature of Wealth Creation

Wealth creation is intrinsically linked to the principles of free-market capitalism, where innovation and entrepreneurship thrive. Historical figures such as Bill Gates, Jeff Bezos, and Paul Allen exemplify how individuals can rise from modest beginnings to achieve significant wealth. This phenomenon underscores the notion that wealth is not a finite resource; rather, it is generated through creativity, hard work, and an entrepreneurial spirit. Capitalism fosters an environment conducive to wealth accumulation, benefiting not just individual entrepreneurs but society as a whole. By incentivizing risk-taking and innovation, capitalism drives economic growth, creating jobs and fostering advancements in technology and services. However, it is crucial to recognize that not everyone has equal access to the opportunities that lead to wealth creation. Structural barriers, such as systemic discrimination and unequal access to resources, can prevent many from participating fully in this economic system. Moreover, the common misconception that wealth is a static resource to be redistributed oversimplifies the complexities of economic dynamics. Understanding that wealth can be created, rather than merely distributed, is essential for fostering an environment that encourages entrepreneurship and innovation. By embracing this perspective, society can work towards creating a more inclusive economic landscape where everyone has the potential to thrive.

The Role of Education in Wealth Inequality

Education serves as a critical determinant of economic opportunity, shaping individuals’ prospects and outcomes in life. Yet, disparities in educational access and quality continue to contribute significantly to wealth inequality. Many public education systems struggle to equip students with the skills necessary to succeed in a competitive job market, perpetuating cycles of poverty and limited opportunities. Access to quality education varies widely based on geographic location, socioeconomic status, and systemic inequities. Students in affluent areas often benefit from better-funded schools, experienced teachers, and a wealth of extracurricular opportunities, while those in underprivileged communities face significant barriers. This lack of equitable access to education not only hinders individual potential but also stifles overall economic growth. Reforming educational institutions is essential to promoting equitable opportunities for all individuals. This includes investing in early childhood education, improving funding for public schools, and ensuring that curricula are inclusive and relevant. By prioritizing education as a means of fostering economic mobility, we can help bridge the gap in wealth inequality and empower future generations to succeed.

Debt and Its Impact on Wealth Generation

Debt poses a significant barrier to wealth generation, affecting millions of Americans and their ability to build financial stability. The burdens of student loans, credit card debt, and mortgages can create a cycle of financial insecurity that is difficult to escape. As individuals struggle to manage their debts, they often find it challenging to save, invest, or pursue entrepreneurial ventures. The pervasive nature of debt influences spending habits, often leading individuals to prioritize immediate financial obligations over long-term wealth-building strategies. This can result in a cycle where individuals remain trapped in financial instability, unable to accumulate savings or invest in opportunities that could improve their economic situation. To combat this issue, fostering a culture of financial literacy is vital. Educating individuals about debt management, budgeting, and investment strategies can empower them to make informed financial decisions. Additionally, advocating for policies that address the root causes of excessive debt, such as student loan reform and accessible financial education, can help individuals navigate their financial challenges more effectively.

The Psychological Aspects of Wealth Inequality

Wealth inequality extends beyond economic implications; it also carries psychological ramifications that can affect individuals and society as a whole. Feelings of envy, resentment, and inadequacy often arise when individuals perceive disparities in wealth and opportunity. These emotions can foster societal divisions, leading to a divisive mindset that undermines social cohesion. Societal narratives surrounding success and failure play a significant role in shaping individuals’ perceptions of wealth. The glorification of wealth and status can create unrealistic expectations, making those who struggle financially feel marginalized or inadequate. Addressing these psychological barriers is crucial for fostering a more inclusive narrative about wealth and success. Promoting a broader understanding of success—one that values diverse paths and recognizes the systemic barriers many face—can help mitigate feelings of envy and resentment. By emphasizing collective success and community well-being, we can shift the narrative around wealth inequality, fostering a more empathetic and supportive society.

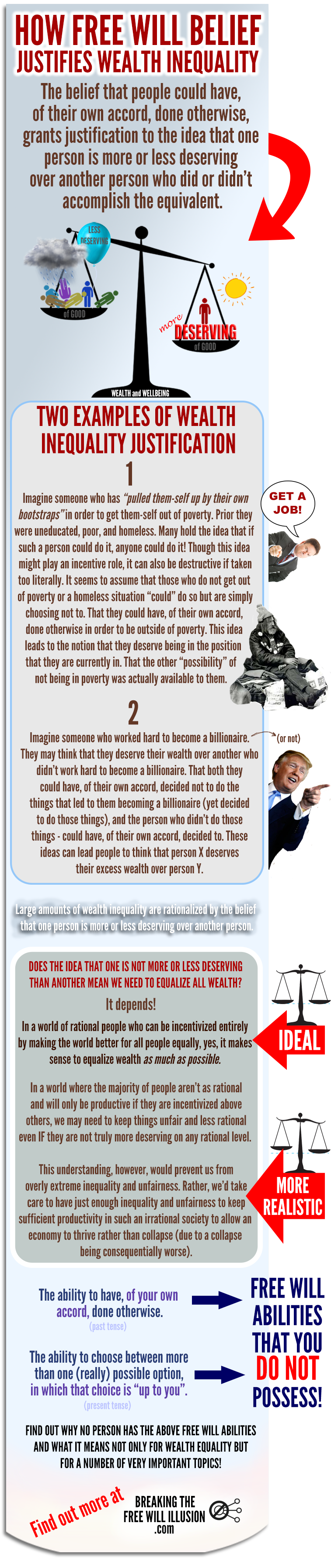

The Myths Surrounding Wealth Redistribution

Wealth redistribution is often surrounded by myths that oversimplify the complexities of economic systems. One common misconception is that wealth can be easily reallocated without consequences. Historical attempts at wealth redistribution have demonstrated that while the intention may be to promote equity, the outcomes can be unintended and counterproductive. Understanding the historical context of wealth redistribution efforts is essential to inform discussions about policy and reform. For instance, certain policies aimed at reducing wealth disparities have led to economic stagnation or disincentivized innovation. A nuanced understanding of these myths is necessary for fostering informed debates about potential solutions to wealth inequality. Debunking myths surrounding wealth redistribution can help create a more informed public discourse. It is vital to recognize that addressing wealth inequality requires a multifaceted approach that considers the complexities of economic systems. By promoting evidence-based discussions, we can pave the way for thoughtful policies that genuinely work towards reducing disparities.

The Case for Capped Capitalism

Capped capitalism presents a potential solution to balance wealth accumulation with social responsibility. This approach proposes implementing caps on excessive wealth to address societal disparities while still fostering innovation and entrepreneurship. By placing limits on extreme wealth, society can ensure that resources are allocated in ways that benefit the broader community. Examples of successful models that combine capitalist principles with social equity can be found across various countries. These models demonstrate that it is possible to encourage wealth creation while also promoting social responsibility. For instance, countries that prioritize progressive taxation and social welfare programs often see more equitable wealth distribution, leading to healthier societies overall. Maintaining incentives for wealth creation while addressing inequality is essential for long-term sustainability. By exploring the potential benefits of capped capitalism, we can initiate discussions about how to create a more balanced economic environment where both individual prosperity and societal well-being are prioritized.

The Future of Wealth Inequality: Trends and Solutions

As we look to the future, it is crucial to analyze emerging trends in wealth inequality and consider potential solutions. Factors such as technology, globalization, and changing labor markets continue to shape economic disparities. The rise of automation and artificial intelligence, for instance, poses challenges for traditional job markets, potentially widening the wealth gap. Innovative policy solutions, including universal basic income (UBI) and targeted social programs, are gaining traction as potential ways to mitigate inequality. UBI proposes providing a guaranteed income to all individuals, regardless of employment status, which could help alleviate poverty and provide a safety net in an evolving job landscape. Collaboration between government, businesses, and individuals is vital for creating a more equitable society. By working together to address the root causes of wealth inequality, we can develop comprehensive solutions that promote economic opportunity for all. Emphasizing the importance of inclusivity and equity in economic discussions will be essential as we navigate the complexities of wealth inequality moving forward.

Conclusion: Embracing Reality and Seeking Solutions

In conclusion, wealth inequality is an enduring reality that requires a multifaceted approach to address. Acknowledging the complexities surrounding wealth creation, education, debt, and societal attitudes is essential for developing effective solutions. By fostering an environment where individuals are encouraged to pursue wealth while also promoting social responsibility, we can create a more equitable society. Embracing a realistic view of inequality can pave the way for constructive dialogue and meaningful change. It is our collective responsibility to ensure that future generations have the opportunity to succeed, regardless of their starting point. By addressing the systemic barriers that perpetuate wealth inequality, we can work towards a society that values both individual aspiration and communal well-being.